AIM Research’s ‘Top Agentic AI Service Providers PeMa Quadrant 2025’ report highlights the top service providers as early movers, along with their capabilities, market trends, and technological developments shaping the industry.

The transition from Generative AI to Agentic AI reflects a broader industry trend driven by the need for more sophisticated, autonomous solutions. Initially, vendors focused on building chatbots and proof-of-concept projects using generative models, leveraging frameworks that enabled simple prompt-based interactions. However, as organizations sought solutions capable of handling complex, multi-step tasks and integrating with diverse data sources, there was a shift toward exploring agentic frameworks. These frameworks, including open-source tools like LangGraph, CrewAI, and AutoGen, as well as cloud-native solutions from major providers, allowed for the creation of autonomous agents that could plan, reason, and execute tasks across multiple tools and systems.

For existing generative AI solutions, vendors offered transformation into agentic systems where it added significant value. A rigorous discovery process ensured that agentic AI was only proposed when it provided tangible benefits beyond generative AI. Key enablers of this transition included foundational expertise in generative models, increasing demand for automation, hands-on experience with various agentic frameworks, and internal testing of solutions within organizational processes. By leveraging their generative AI knowledge and adapting to emerging needs, vendors are successfully positioning themselves as key players in the agentic AI space, driving its advancement across industries.

The journey into Agentic AI for most vendors began with a combination of client-driven projects and internal process improvements. Although the market is still in its early stages, many vendors have moved beyond establishing roadmaps and early POCs. This shift is largely fueled by clients’ growing understanding of AI maturity. Enterprises have gained a deeper understanding of AI capabilities through their experiences with generative AI. This maturity enables them to better articulate their needs and collaborate effectively with vendors to co-create solutions. As a result, they are approaching vendors with specific challenges that Agentic AI can address, accelerating the transition from experimentation to implementation.

Modular Architectures: Leading vendors are emphasizing modular, pluggable architectures to enable seamless orchestration, integration with enterprise systems, and future-ready scalability of agentic AI systems.

Orchestration Maturity Varies Widely: While some vendors offer advanced agent ecosystems with task decomposition and memory, others are still in the early stages of orchestration maturity, offering single-task agents or limited coordination.

Observability & Governance as Differentiators: Vendors are prioritizing agent monitoring, behaviour explainability, audit trails, and role-based control to meet enterprise governance and trust requirements.

Low-Code/No-Code Agent Development: A growing number of providers are offering low-code tools and SDKs for rapid customization and deployment of pre-trained or composable agents.

Vendor-Agnostic Integration Strength: Service providers are building solutions that integrate seamlessly across heterogeneous enterprise stacks and AI ecosystems, avoiding lock-in and supporting hybrid workflows with traditional ML and LLMs.

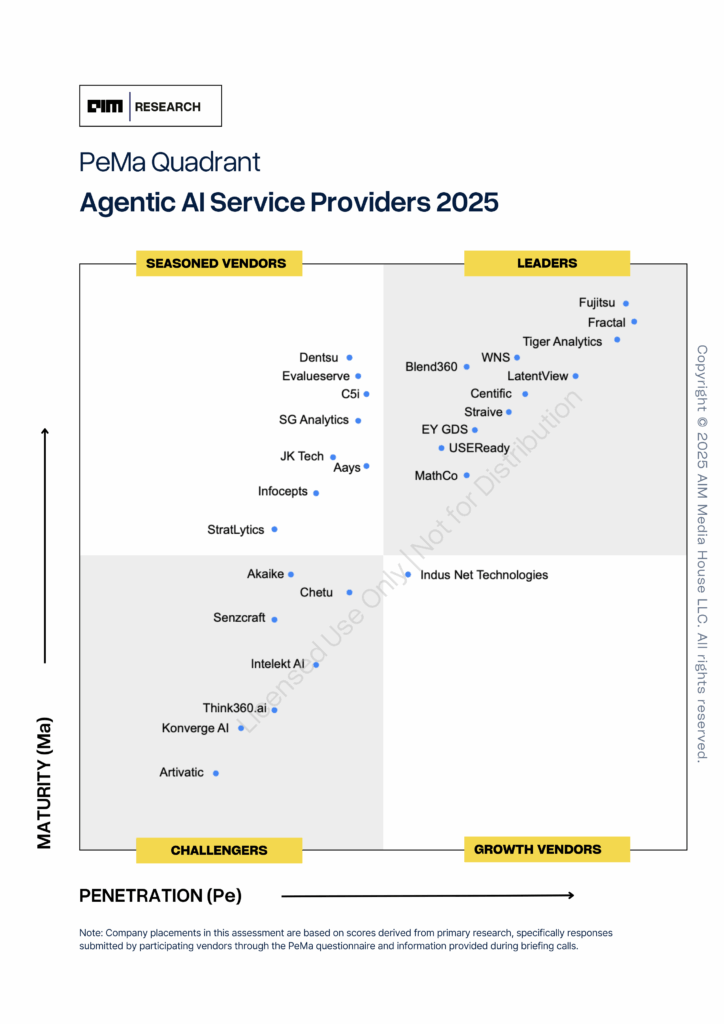

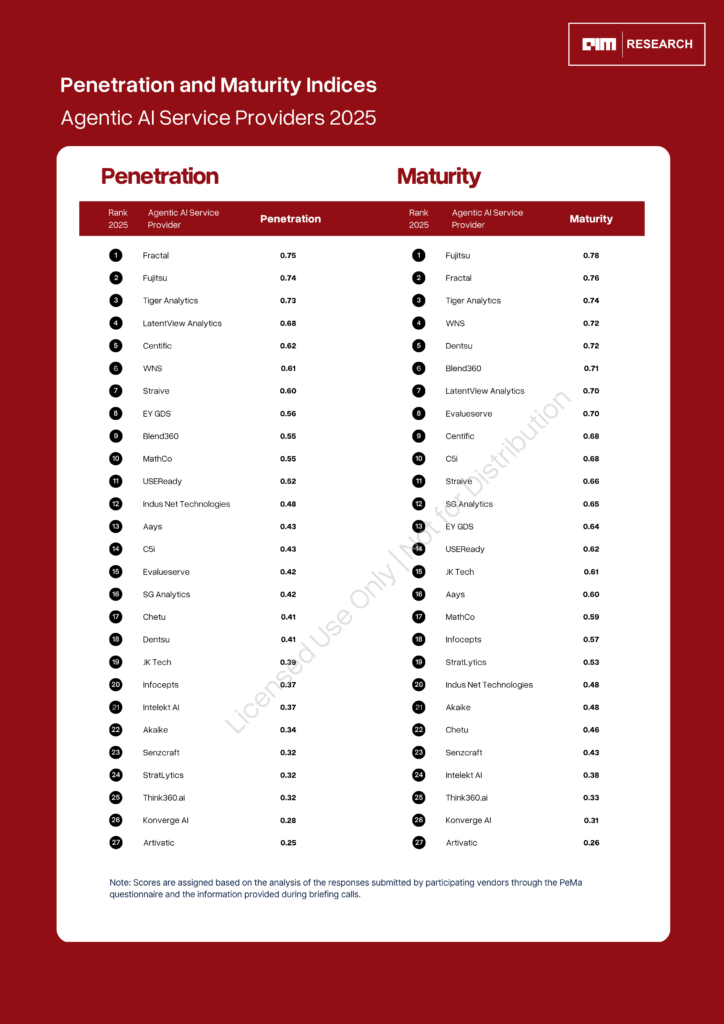

27 Agentic AI service providers participated in this study by responding to the PeMa questionnaire and attending briefing calls. The assessment is made based on vendors’ service scope, customer base & growth, partnerships, outcomes & ROI, industry focus, technology stack, multi-agent orchestration, governance & ethics, recent deployments, and integration capabilities.

Featured Vendors (in alphabetical order):

Aays, Akaike, Artivatic, Blend360, C5i, Centific, Chetu, Dentsu, Evalueserve, EY GDS, Fractal, Fujitsu, Indus Net Technologies, Infocepts, Intelekt AI, JK Tech, Konverge AI, LatentView, MathCo, Senzcraft, SG Analytics, Straive, StratLytics, Think360.ai, Tiger Analytics, USEReady, and WNS.

Table of Contents:

Market Outlook:

Agentic AI Service Providers PeMa Quadrant 2025:

Vendor Profiles – Capabilities and Differentiators

$2,999.00