AIM Research’s PeMa Quadrant report provides tech buyers with an analyst’s view of how the data science market is evolving and how vendors are adapting. The vendor profiles outline each firm’s core capabilities, and the PeMa Quadrant highlights their relative positions on market penetration and technology maturity. While the report and the Quadrant acts as a comprehensive guide for tech buyers, it should be treated as one leg of the stool among other RFP criteria (your buying process), since each tech buyer’s maturity varies and they will require a partner suited to their specific capability gaps.

The data science services market today reflects a hybrid model that combines traditional project-based engagements with growing demand for continuous, operationalized capabilities, driven by changes in how enterprises fund, adopt, and integrate analytics and AI. Taking note, some vendors anchor around engineering readiness; others around decision-led value pathways; and a growing group around GenAI- and Agentic-led workflow design. Ownership is consolidating under CIOs because deploying AI systems requires cloud-native architectures, tighter integration with core platforms, and continuous value measurement rather than isolated experiments. As a result, partnerships with hyperscalers, the ability to work across multi-cloud environments, & the integration of domain accelerators into client ecosystems are becoming table stakes.

Traditional machine learning continues to play a central role in enterprise programs. Many high-value use cases remain grounded in structured modeling for forecasting, optimization, pricing, targeting, uplift modeling, and risk. These areas require explainable, stable, and scalable methods that fit regulatory and operational demands. GenAI expands the scope of analytics by accelerating discovery, enabling multi-agent workflows, and handling unstructured content at scale, but it operates alongside the ML systems that support core business decisions. Many providers now combine both. For example, they use GenAI to speed early exploration, automate components of governance or BI modernization, and create interaction layers, while relying on mature ML to deliver predictable outcomes in functions such as supply chain, marketing, commercial lending, and manufacturing.

Industry penetration concentrates around data-rich verticals. Retail and BFSI dominate vendor portfolios, followed by healthcare/pharma, media/telecom, and industrial. This concentration reflects where data maturity, budget availability, and transformation mandates converge to create repeatable demand.

Hyperscalers have become key distribution channels, while data and AI platform alliances have grown in strategic importance. AWS, Azure, GCP, Snowflake, and Databricks are now central to vendors’ GTM. Certifications, marketplace listings, co-sell motions, and joint solution plays increasingly influence deal access and enterprise trust. Although vendors list many partners, Azure and Databricks form the dominant operational stack.

Predictive and prescriptive analytics remain core Across vendors, predictive and prescriptive work dominates delivery volume. Cognitive workloads for GenAI and Agentic led use cases are rising, but foundational ML continues to drive enterprise value, particularly in operations, forecasting, and optimization.

Accelerators and platforms have become table stakes. Most accelerators fall into a few dominant functional themes: unstructured intelligence, forecasting and planning, RGM/marketing analytics, MLOps/LLMOps governance, Agentic orchestration, and data modernization. Differentiation comes from the maturity, value realization, and unification of these assets into a cohesive delivery platform, which influences speed, repeatability, and the ability to scale outcomes across functions.

Data foundation and modernization projects appear in almost every vendor portfolio. Many ML and GenAI deployments are impossible without foundational data engineering. Clients often initiate AI programs only after addressing lineage gaps, quality issues, and fragmentation.

Vendors cluster into three groups shaped by their delivery foundations. Engineering-led providers frame strategy around platform readiness and constraints in data quality, lineage, and cloud architecture. Decision-led providers structure strategy around value pathways, surfacing business-linked use cases earlier. Modern analytics (GenAI or Agentic-led) providers assume workflow automation from the start, using copilot and scenario-modeling techniques to shorten roadmap cycles.

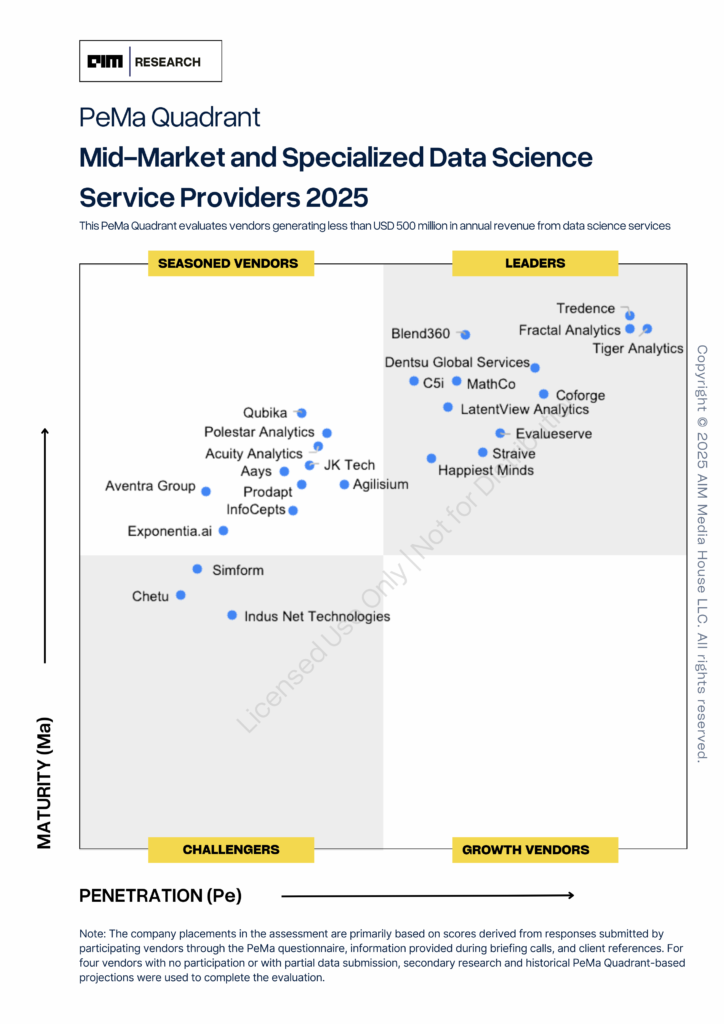

A total of 25 vendors are featured in the PeMa Quadrant study Vendors are evaluated on delivery scale and financial health, growth, customer confidence, and company outreach, which reflect market penetration (Pe), and on work delivery, tech advancement, employee maturity, and support infrastructure, which reflect technology maturity (Ma).

Featured Vendors (in alphabetical order):

Aays, Acuity Analytics, Agilisium, Aventra Group, Blend360, C5i, Chetu, Coforge, Dentsu Global Services, Evalueserve, Exponentia.ai, Fractal Analytics, Happiest Minds, Indus Net Technologies, InfoCepts, JK Tech, LatentView Analytics, MathCo, Polestar Analytics, Prodapt, Qubika, Simform, Straive, Tiger Analytics, Tredence.

Table of Contents:

Market Outlook:

The Data Science Services PeMa Quadrant:

Vendor Profiles – Capabilities and Differentiators

Concluding Remarks

How to access the report?

To access the full report, you may purchase it for USD 10,000 for internal use. A separate reprint license is required for any external or marketing use. Please reach out to info@aimresearch.co for further details on the commercials.

$10,000.00