The MLOps landscape is evolving rapidly, driven by advancements in AI, cloud-native technologies, and the growing demand for scalable, governed AI solutions. The 2025 AIM Research MLOps PeMa Quadrant report highlights the top service providers, market trends, and key differentiators shaping the industry.

The MLOps market is currently undergoing rapid evolution, requiring service providers to demonstrate advanced technological maturity and a broader spectrum of service offerings. Looking ahead to 2025, the market is poised for further transformation, driven by the dominance of Generative AI and large language models (LLMs), which will fuel demand for specialized LLMOps capabilities such as fine-tuning, deployment, monitoring, and governance.

Responsible AI practices, addressing bias detection, explainability, and ethical considerations, will become imperative, with providers integrating these principles. There will be increased convergence of MLOps with other ‘XOps’ practices like DataOps, ModelOps, LLMOps, and AgentOps, promoting a holistic approach to AI operationalization across the AI lifecycle. The adoption of cloud-native technologies and edge computing will accelerate, enabling scalable and flexible MLOps deployments. Finally, the automation of MLOps workflows, leveraging AI to optimize processes, will enhance efficiency. Overall, the MLOps market is set for continued growth and transformation, driven by technological advancements, evolving client needs, and the increasing recognition of MLOps as a critical enabler of successful AI adoption.

1. XOps Integration: There will be increased convergence of MLOps with other ‘XOps’ practices like DataOps, ModelOps, LLMOps, and AgentOps, promoting a holistic approach to AI operationalization across the AI lifecycle.

2. AI Governance & Compliance Leadership: Strong focus on observability, drift detection, and adherence to regulatory frameworks (GDPR, HIPAA), ensuring responsible AI adoption.

3. Proprietary Accelerators & Automation: Vendors are developing pre-configured frameworks and reusable MLOps components to streamline workflows, reduce costs, and improve efficiency.

4. Integration with Hyperscalers & AI Platforms – Strengthening partnerships with AWS, Azure, GCP, and platforms like Snowflake, Databricks, and Dataiku for seamless ecosystem integration.

5. Industry-Specific MLOps Solutions: Tailored solutions are being developed for finance (fraud detection), manufacturing (predictive maintenance), healthcare (regulatory compliance), and other industries.

6. Investment in AI Innovation Labs/Center of Excellence: Focus on R&D for cutting-edge AI/ML solutions, including Agentic AI, automation, and responsible AI frameworks to stay ahead of market trends.

7. Areas considered for advancement in the last year: Maturity frameworks, accelerators, strategic partnerships with cloud providers and platforms that strengthen data layer capabilities, open-source and reusability, advanced monitoring and observability, automation and cost-optimization, GenAI monitoring and governance frameworks, and upskilling and certifications.

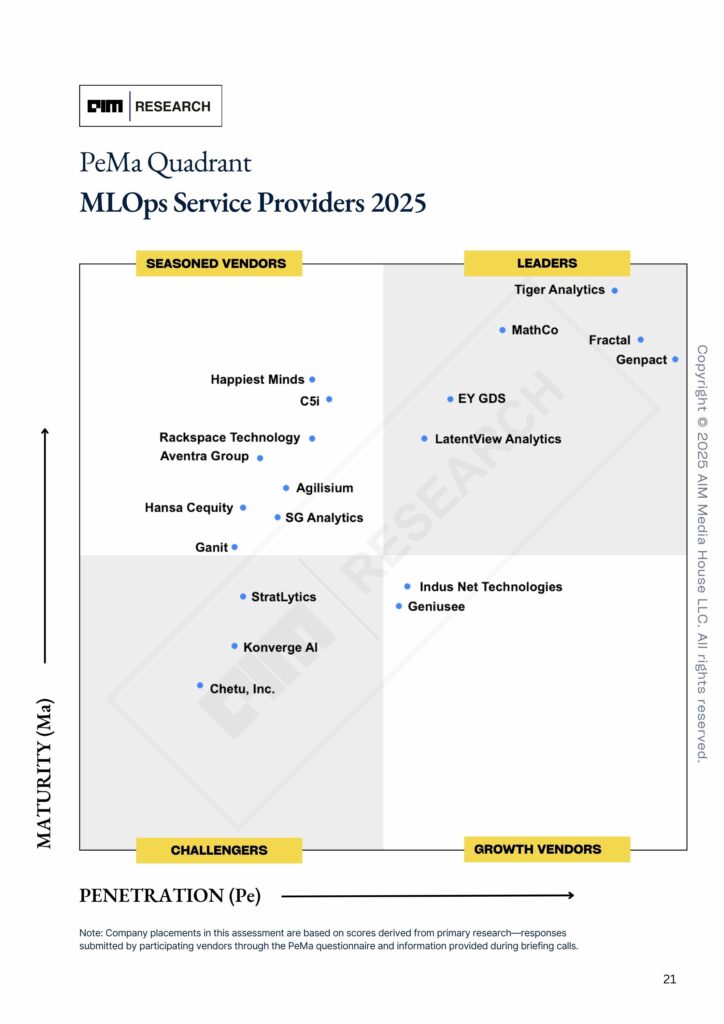

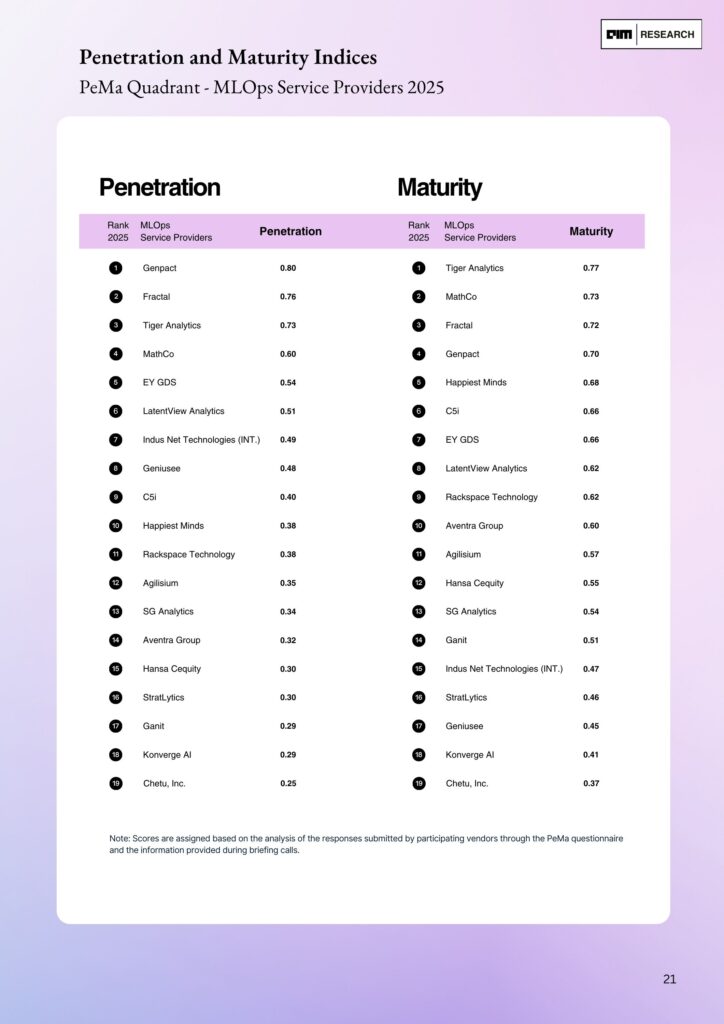

Nineteen ‘Data and AI’ service providers (vendors) participated in this study by responding to the PeMa questionnaire and attending briefing calls. The assessment is made based on vendors’ market reach and presence, customer confidence and partnerships, future roadmap, end-to-end capabilities, innovation, scalability and cost optimization, and support infrastructure.

Featured Vendors (in alphabetical order):

Agilisium, Aventra Group, C5i, Chetu Inc., EY GDS, Fractal, Ganit, Geniusee, Genpact, Hansa Cequity, Happiest Minds, Indus Net Technologies (INT.), Konverge AI, LatentView Analytics, MathCo, Rackspace Technology, SG Analytics, StratLytics, and Tiger Analytics.

Table of Contents:

Market Outlook:

MLOps Service Providers PeMa Quadrant 2025:

Vendor Profiles – Capabilities and Differentiators

$2,999.00