AIM Research’s Data Engineering PeMa Quadrant 2025 report highlights the top service providers and their capabilities, market trends, and technology developments shaping the industry.

The data engineering services market has entered a new phase of transformation—shaped by the dual forces of artificial intelligence and cloud-native solutions. Service providers are being assessed not only on their ability to deliver structured, high-quality data for downstream analytics but also on how intelligently they can automate and enhance the data engineering lifecycle itself. AI-augmented engineering has emerged as a defining theme, with generative and agentic AI being embedded into pipelines, orchestration frameworks, quality checks, and migration accelerators.

Data engineering today sits at the core of enterprise innovation. Organizations are not only preparing data for AI-led solutions, but also leveraging AI to reimagine how data systems are built, optimized, and scaled—driving greater efficiency and agility across the data lifecycle.

Vendors are witnessing a sharp rise in project volumes, driven by enterprise-wide modernization mandates, growing demand for AI-focused data product lifecycles, the scaling of DataOps practices, and heightened focus on data governance and compliance. As organizations modernize legacy systems, platform transformation strategies have also matured. The focus has shifted from basic lift-and-shift migrations to outcome-driven modernization—where success is defined by automation coverage, semantic model implementation, and business-aligned data products that support agile decision-making.

Ultimately, what distinguishes leading service providers is their ability to deliver measurable business outcomes. Reductions in data latency, improvements in reliability, acceleration of AI deployment timelines, and cost efficiencies are now central to evaluating engineering performance. In this landscape, the role of data engineering has expanded from an enabler to a differentiator—where the true competitive edge lies in how seamlessly intelligence is woven into every layer of the engineering fabric.

1. Data Engineering Services are Now AI-Embedded: The market has evolved from data enablement to AI-embedded engineering, where generative and agentic AI are embedded into pipelines, quality checks, metadata discovery, and orchestration workflows—making AI integration the new default across services.

2. Full Lifecycle Coverage Is Now Standard: Most service providers offer everything from data ingestion and platform engineering to observability, ML enablement, and AI delivery—converging previously siloed services.

3. From Service to Solution Mindset:Vendors are evolving from implementation providers to strategic solution partners, embedding product-centric and AI-native thinking into their approach. By leveraging proprietary IPs, GenAI frameworks, and modular toolkits, they are engineering scalable, low-maintenance, and reusable data products that align with business goals and adapt with LLM maturity and AI evolution.

4.DataOps is No Longer Optional: CI/CD for data pipelines, observability dashboards, and FinOps integration are now table stakes. Service providers are driving this evolution to enable high-frequency releases, traceability, and cost optimization.

5. Strategic Modernization Roadmaps, Not Just Migrations: The focus has shifted from “lift-and-shift” to outcome-driven replatforming—emphasizing automation, semantic readiness, and metadata-driven execution. This is key to future-proofing data estates.

6. Lean Teams with Hyperautomation Capabilities: Using AI-powered observability and modular architecture, vendors have demonstrated massive productivity gains.

7. Hyperscaler Partnerships Drive Innovation: Most firms have deep partnerships with AWS, Azure, GCP, Databricks, Snowflake, gaining early access to new features and co-developing industry-specific solutions.

8. Self-Service and Democratization as Must-Haves: Visual data catalogs, business-friendly search, and no-code environments are driving faster enterprise adoption and reducing IT dependency.

9. Demand for Talent & Upskilling is at a Peak: Almost all vendors have institutionalized certification programs across cloud platforms (AWS, Azure, GCP), Databricks, and Snowflake—indicating that talent readiness is as critical as tech maturity.

10. Global Expansion is Intensifying: Vendors are deepening their presence in the US and aggressively expanding to Europe, Southeast Asia, ANZ, and LATAM. India remains a core delivery hub with increasing strategic importance.

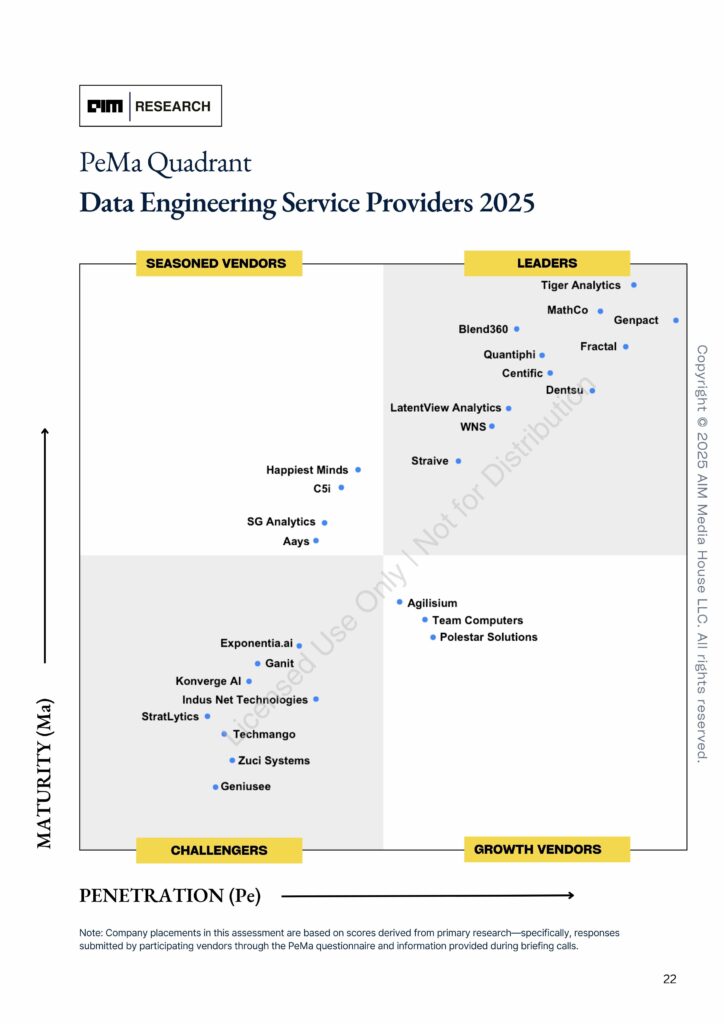

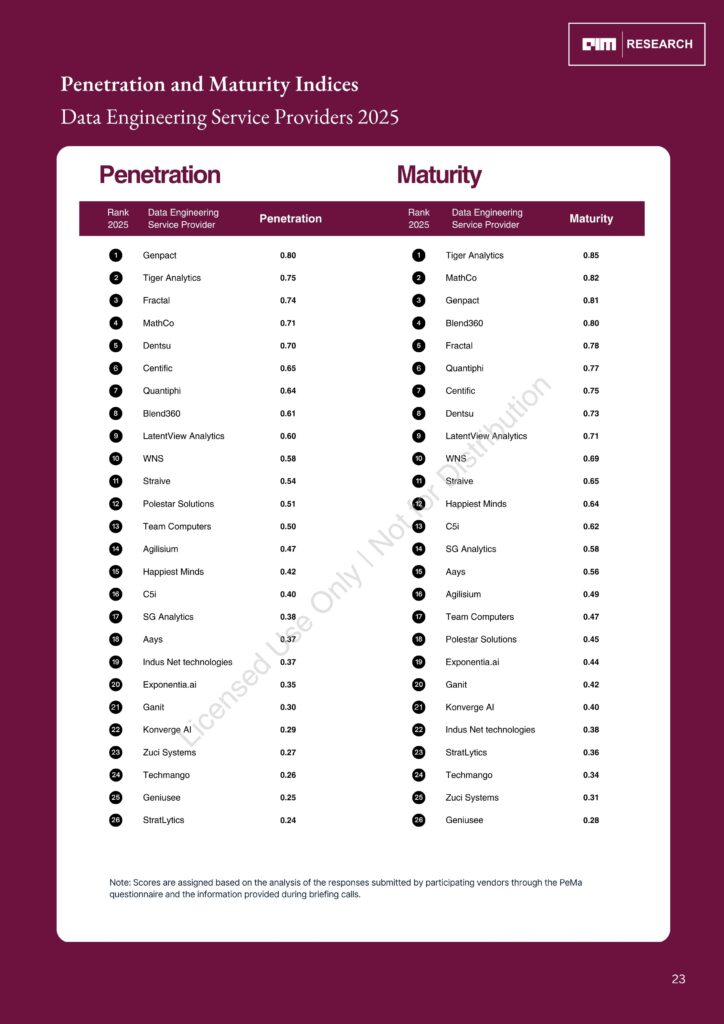

26 data engineering service providers participated in this study by responding to the PeMa questionnaire and attending briefing calls. The assessment is made based on vendors’ market reach and presence, customer confidence and partnerships, future roadmap, end-to-end capabilities, innovation, scalability and cost optimization, and support infrastructure.

Featured Vendors (in alphabetical order):

Aays, Agilisium, Blend360, C5i, Centific, Dentsu, Exponentia.ai, Fractal, Ganit, Geniusee, Genpact, Happiest Minds, Indus Net technologies, Konverge AI, LatentView Analytics, MathCo, Polestar Solutions, Quantiphi, SG Analytics, Straive, StratLytics, Team Computers, Techmango, Tiger Analytics, WNS, and Zuci Systems.

Table of Contents:

Market Outlook:

Data Engineering Service Providers PeMa Quadrant 2025:

Vendor Profiles – Capabilities and Differentiators

$2,999.00