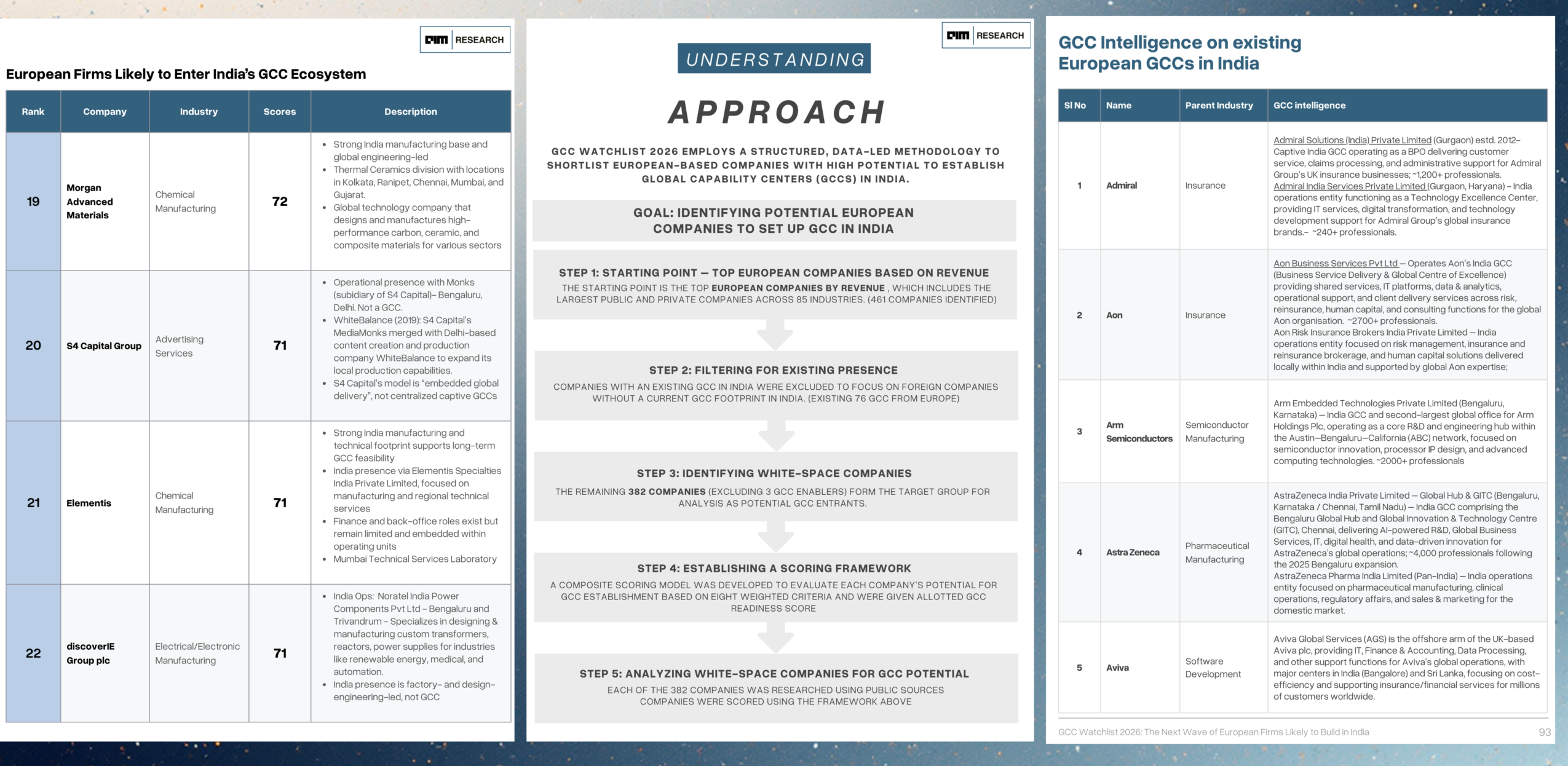

The GCC Watchlist 2026 identifies the Top 50 European (including UK) firms most likely to establish India centers. Using a proprietary 8-factor scoring model, the report analyzes an active landscape of 382 companies. It further provides comprehensive intelligence profiles for 76 established European GCCs to benchmark and map high-value investment trends.

GCC Watchlist 2026 : Top European Companies Likely to Establish GCCs in India

somdn_product_page