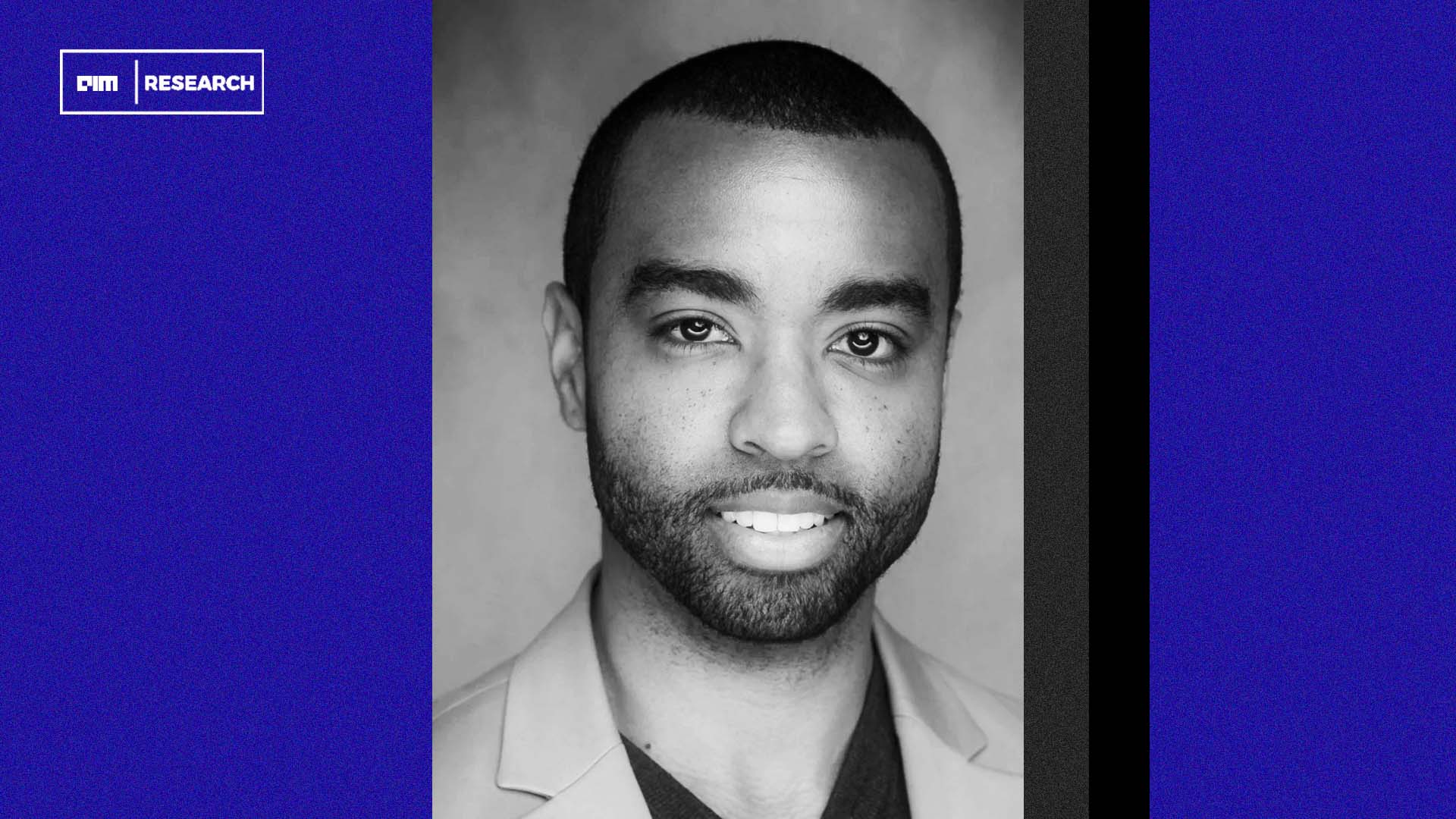

Jason McBride Is Joining AIX Ventures As Partner To Lead Investments In AI Applications

- By Anshika Mathews

- Published on

AI can move us from hindsight to foresight identifying and remediating risks before they impact operations.

“There’s never a dull day in venture,” says Jason McBride, and he would know. For the past 15 years, he’s operated at the intersection of enterprise infrastructure and innovation, first at Microsoft, where he led partnerships across SaaS, DevOps, and cybersecurity during the company’s pivotal cloud transformation years, and later at M12, Microsoft’s venture arm, where he placed early bets on AI startups tackling deeply embedded enterprise pain points long before AI became a boardroom buzzword.

Now, McBride is joining AIX Ventures as a Partner to lead AI investments. In an exclusive interview with AIM Research, McBride said what stood out about AIX Ventures was its “thematic focus on AI-native technologies and deep subject matter expertise.” He believes the venture landscape is shifting toward specialization and that firms like AIX are ahead of the curve. “The most successful funds going forward will be thesis-driven, and that’s exactly where AIX excels.”

AIX’s focused approach has already paid off, with a portfolio that includes Hugging Face, Windsurf, and Perplexity. For McBride, this narrow lens proves that thematic depth doesn’t limit scale. Instead, it’s a signal of clarity and conviction qualities he says are necessary in today’s venture market.

McBride brings with him a multidisciplinary approach shaped by a career that spans law, sales, product, and business development. “To succeed in venture capital, you have to integrate knowledge from across functions,” he noted. That perspective guided much of his work at M12, where he led investments in companies like Solve Intelligence, an AI-native platform that speeds up the creation and evaluation of patents.

“It’s a perfect example of a painkiller,” McBride said. “Patents are expensive and time-intensive to produce. Solve Intelligence helps legal teams do more with less without cutting into law firm economics, since most charge flat fees. It’s a win-win that increases both matter velocity and volume.”

He elaborated further: “Solve Intelligence is an AI-native solution designed to expedite the creation and evaluation of patents. This is a prime example of a ‘painkiller’ because patents can be incredibly costly and labor-intensive to develop. Additionally, patents are often charged on a fixed-fee basis, which makes speeding up the patent creation process through AI not only more efficient but also enhances the existing business model where matter velocity and volume are front and center. This is a win-win for both the industry and patent creators, as it allows all parties to do more with less while accelerating innovation without adversely impacting a law firm’s bottom line.”

The “painkiller versus vitamin” distinction is one McBride returns to often when describing what makes a startup worth backing. “Two of my most meaningful investments to date are Solve Intelligence and Zenity.io. I find both companies particularly exciting because they have the potential to be ‘painkillers’ rather than ‘vitamins’the key distinction being that a painkiller addresses a critical need, while a vitamin is merely a nice-to-have.”

Zenity, another McBride portfolio company, applies AI to streamline security workflows—an area he believes will only grow in importance as companies scale up their AI deployments internally. “These aren’t speculative tools,” he said. “They’re solving something real.”

But McBride’s investment appetite doesn’t stop at legaltech and cybersecurity. He’s also bullish on what he calls “unsexy categories that can become big businesses,” citing supply chain as one of the most compelling. “AI can move us from hindsight to foresight identifying and remediating risks before they impact operations. That’s a material shift for any business’s bottom line.”

He elaborated: “While supply chains can vary depending on the organization and business type, it’s clear that disruptions in the supply chain can have a material impact on a company’s bottom line. Advancements in AI have the potential to move well beyond historical data and remediate these disruptions before they can occur, which is a more proactive approach than what we are generally used to.”

McBride’s view of venture is deeply grounded in experience. He’s served on more than 20 boards, founded a legaltech startup focused on document automation, and held scout roles at Lightspeed. That operator-investor hybrid background, he says, gives him a sharper lens on which startups are solving not just interesting problems, but mission-critical, operationally messy ones that enterprises are willing to pay to fix.

Shaun Johnson, General Partner at AIX Ventures, agrees. “Jason brings a deep understanding of the AI application layer and how startups can deploy at scale inside large enterprises. That’s invaluable at this moment of corporate transformation.”

Verticalized AI remains central to McBride’s strategy which is backing companies that begin with a focused use case and expand with discipline. “We’re seeing increased funding in patent solutions, not just for creation, but for licensing, harvesting, and prosecution,” he said. The same principle holds across other AI application-layer plays: go deep before going wide. Or as McBride puts it, “boil a pot of water, not the ocean.”

📣 Want to advertise in AIM Research? Book here >

Cypher 2024

21-22 Nov 2024, Santa Clara Convention Center, CA

A Vendor Briefing is a research tool for our industry analysts, and an opportunity for a vendor to present its products, services and business strategies to analysts who cover the vendor specifically or a related technology or market.

AIM Research encourages technology vendors and agencies to brief our team for PeMa Quadrants, when introducing a new product, changing a business model, or forming a partnership, merger, or acquisition.