The GCC enablement market is moving decisively away from transactional setup work toward lifecycle ownership, shaped by how global enterprises now think about offshore capability. What began as advisory-led entity formation and operational launch has evolved into a structured, outcomes-driven discipline focused on building GCCs as long-term extensions of the global enterprise. Clients are no longer engaging enablement partners simply to stand up centers quickly or cheaply. Instead, they are seeking partners who can co-design operating models, embed governance, and ensure that GCCs deliver sustained efficiency, innovation, and strategic relevance over time.

This shift mirrors the broader evolution of GCCs themselves. Once positioned primarily as cost-arbitrage delivery hubs, GCCs are now expected to own complex, multi-functional mandates across digital engineering, data and AI, analytics, and core business operations. Early enablement engagements were execution-heavy, centered on location selection, infrastructure readiness, talent onboarding, and steady-state operations. As enterprises matured in their offshore strategies, expectations expanded. GCCs are increasingly embedded in enterprise transformation agendas, with accountability for productivity, capability depth, and business outcomes rather than headcount scale alone.

For organizations with established centers, enablement demand is increasingly transformation-led. Providers are brought in to re-architect operating models, rebalance talent pyramids, strengthen leadership and governance layers, and introduce standardized performance, cost, and delivery frameworks. These engagements typically begin with rigorous diagnostics, ensuring that interventions are aligned to enterprise maturity and business priorities rather than applied generically. Over time, providers have codified this experience into repeatable playbooks, frameworks, and toolkits, allowing them to move from bespoke advisory toward scalable, lifecycle-oriented delivery without losing contextual depth.

Adoption of GCC enablement services is now accelerating across new setups, scale-up mandates, and targeted transformation initiatives. While large global enterprises in BFSI, retail, healthcare, manufacturing, and technology continue to anchor demand, mid-market enterprises are entering the GCC landscape in growing numbers. These organizations often require advisory-led partners who can guide first-time setups while simultaneously future-proofing centers for specialization, leadership depth, and innovation. In response, providers are repositioning themselves as long-term partners responsible not just for establishing GCCs efficiently, but for continuously optimizing and evolving them in line with enterprise strategy, signaling a clear shift from one-time execution to sustained value creation as the core of GCC enablement.

Key Findings

Convergence Toward End to End GCC Enablement: The GCC enablement market is increasingly converging toward end to end services delivery. Providers across all categories including IT services firms, consulting and Big 4/5 audit firms, real estate led advisors, specialist boutiques, platform led vendors, and industry focused firms are expanding beyond their traditional roles to offer full lifecycle GCC enablement through in house capabilities or partner ecosystems rather than operating as point solution providers.

Rise of Specialized and Strategic Functions: Demand is shifting rapidly toward building AI, data, cybersecurity, cloud engineering, and R&D CoEs, moving GCCs beyond traditional shared services into strategic capability hubs.

AI and Agentic AI as Core Differentiators: GenAI and agentic AI capabilities are now embedded into GCC operating models, with vendors using proprietary platforms and frameworks to drive automation, decisioning, and value creation.

Platform-Led and Framework-Driven Differentiation: Proprietary industry specific and Analytics/AI focused playbooks, accelerators, maturity models, and governance frameworks are increasingly central to vendor differentiation and execution consistency.

Vendors with Integrated Talent Engines Are Outperforming: Service providers that combine recruitment, structured upskilling, internal academies, and certification programs are demonstrating superior delivery outcomes. Their ability to supply “day-one ready” talent significantly reduces ramp-up time and attrition risk for GCC clients.

Tier-2 Cities Are Emerging as Skilled Talent Hubs, Not Just Cost Centers: Tier-2 locations are gaining relevance not only for cost optimization but also for specialized talent pools in engineering, analytics, and operations. This evolution is reshaping GCC location strategies and widening the talent funnel beyond Tier-1 saturation zones.

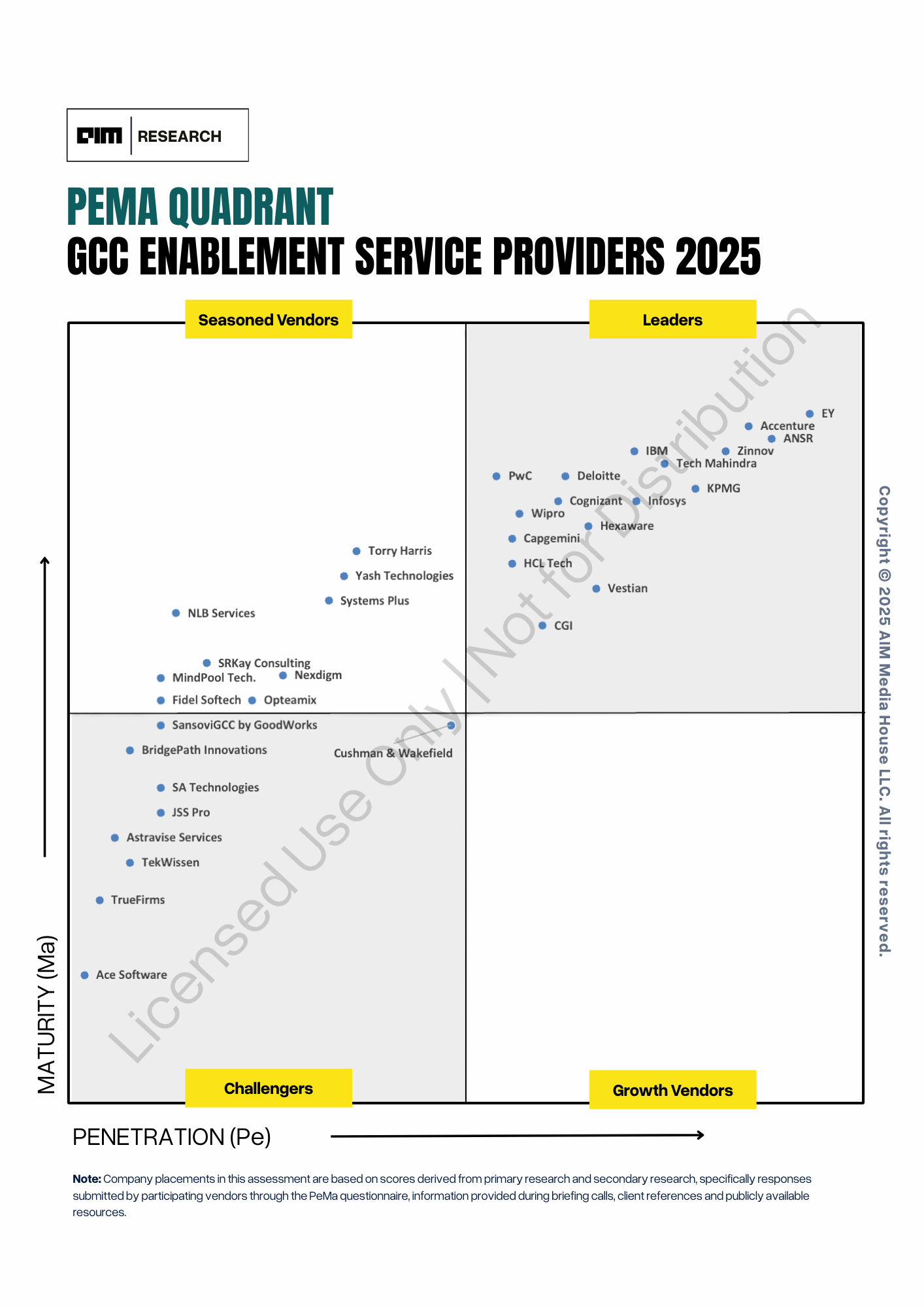

PeMa Quadrant

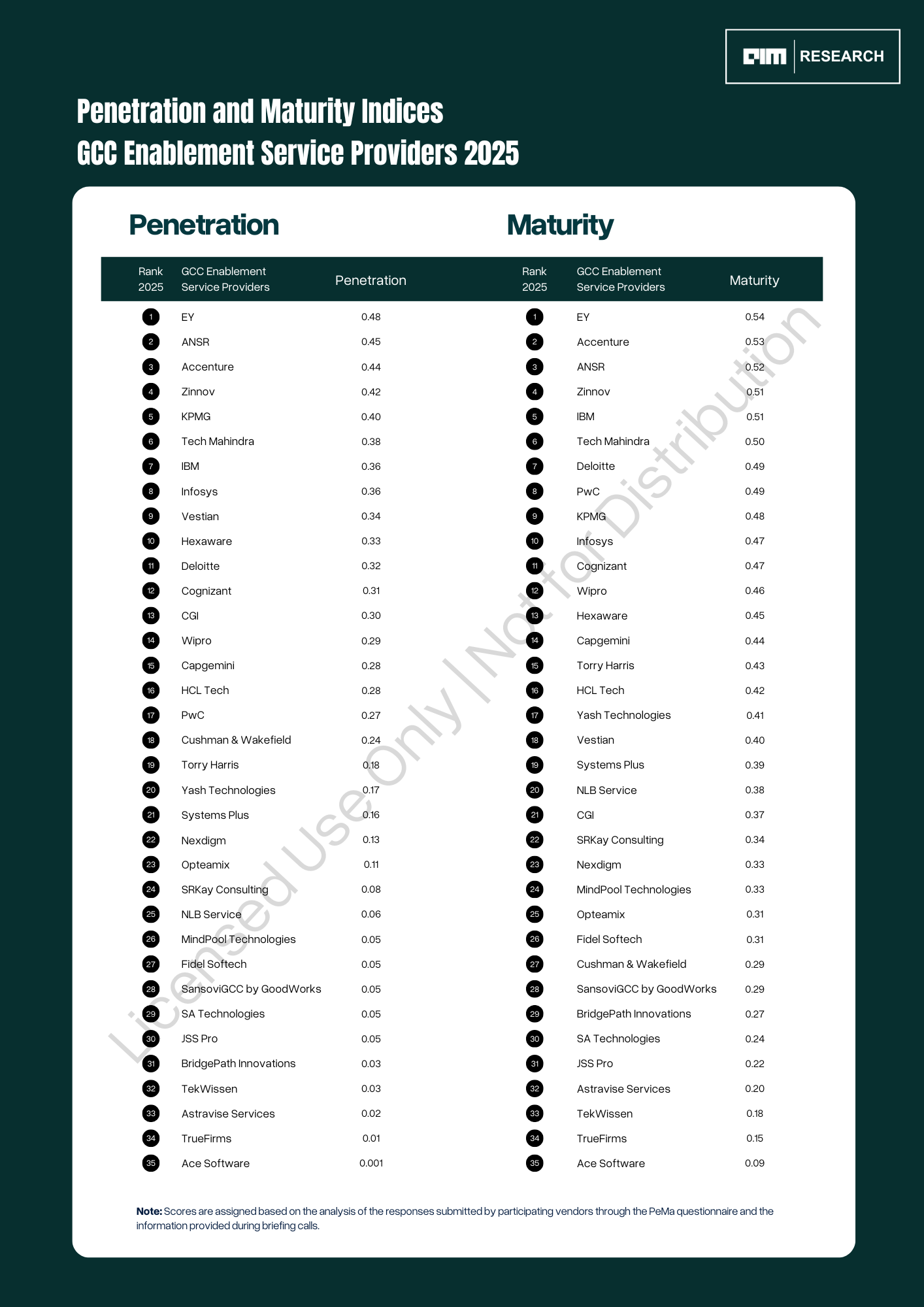

A total of 35 vendors are featured in the PeMa Quadrant study Vendors are evaluated on delivery scale and financial health, growth, customer confidence, and company outreach, which reflect market penetration (Pe), and on work delivery, tech advancement, employee maturity, and support infrastructure, which reflect technology maturity (Ma).

Featured Vendors (in alphabetical order):

Accenture, Ace Software Exports Limited, ANSR, Astravise Services Pvt Ltd, BridgePath Innovations, Capgemini, CGI, Cognizant, Cushman & Wakefield, Deloitte, EY, Fidel Softech Limited, GoodWorks CoWork (SansoviGCC by GoodWorks), HCL Tech, Hexaware, IBM, Infosys, JSS Pro, KPMG India, Mindpool Technologies Ltd, Nexdigm, NLB Services, Opteamix, PwC, SA Technologies Inc, SRKay Consulting Group, Systems Plus, Tech Mahindra, TekWissen, Torry Harris Integration Solutions, TrueFirms, Vestian, Wipro, Yash Technologies, Zinnov.

Table of Contents:

Market Outlook:

- Introduction to the GCC Enablement Services

- GCC Enablement Services Definition

- Types of GCC Enablement Services

The GCC Enablement PeMA Quadrant:

- The Quadrants

- PeMa Quadrant 2025

- Penetration and Maturity Indices

Vendor Profiles – Capabilities and Differentiators

Concluding Remarks

How to access the report?

To access the full report, you may purchase it for USD 10,000 for internal use. A separate reprint license is required for any external or marketing usage. Please reach out to info@aimresearch.co for further details on the commercials.