Snowflake is Still a Winner in the Making Despite Market Missteps

- By AIM Research

- Published on

Despite market challenges, Snowflake remains a resilient leader in cloud data, poised for long-term growth through strategic focus and innovation.

Warren Buffett’s investment strategy is legendary for its focus on value, simplicity, and predictability. When he made a rare exception to his rule against investing in tech stocks by buying into Snowflake during its IPO, it raised eyebrows across Wall Street. Now, with Snowflake’s stock trading below its IPO price and netting negative returns over the past four years, some are quick to label this a misstep. However, such a view overlooks Snowflake’s fundamental strengths and its potential to emerge stronger than ever. Despite market challenges, Snowflake remains a formidable player in the cloud data space, and its future prospects are far from bleak.

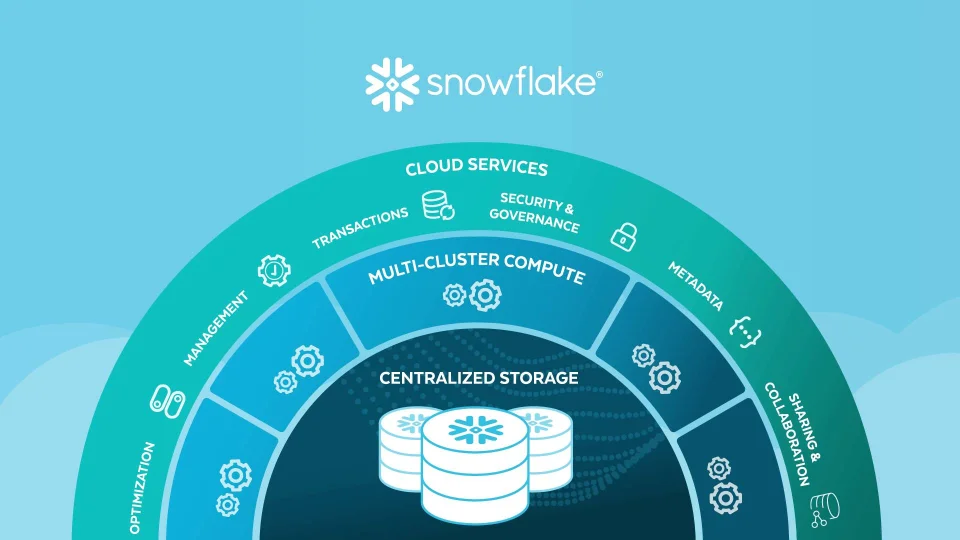

Snowflake’s story begins with a revolutionary approach to data warehousing. By offering a cloud-native solution that seamlessly integrates with existing enterprise systems, Snowflake set itself apart from traditional on-premises data warehouses. Its unique architecture, which separates storage and compute, allows businesses to scale their data operations efficiently, a feature that has been key to its rapid adoption across industries.

One of the reasons for Snowflake’s success is its consumption-based pricing model, which aligns with the actual usage of its customers. This model not only makes Snowflake more accessible to businesses of all sizes but also ensures a steady stream of recurring revenue. As of its latest quarterly report, Snowflake’s product revenue grew by 30% year-on-year, despite a challenging economic environment. This growth is a testament to the company’s ability to deliver value to its customers, even as it faces increased competition.

While some critics argue that Snowflake missed opportunities by not expanding aggressively through acquisitions like Salesforce did under Marc Benioff, it’s important to recognize that Snowflake has chosen a more measured, strategic approach. Frank Slootman, Snowflake’s CEO from Apr 2019 – Mar 2024, has focused on solidifying the company’s core offering rather than spreading too thin too quickly. This focus has allowed Snowflake to build a robust, scalable platform that serves as a critical piece of infrastructure for its customers.

Snowflake’s decision to concentrate on its core product—the Snowflake Data Cloud—has positioned it as a leader in the data warehousing space. Unlike companies that diversify too quickly and lose focus, Snowflake has doubled down on what it does best: enabling businesses to store, manage, and analyze massive amounts of data in a secure, scalable environment.

This focus has paid off in the form of strong customer retention and growth. Snowflake’s net retention rate stands at 127%, indicating that not only are customers sticking around, but they’re also increasing their use of Snowflake’s services. This level of customer loyalty is rare and underscores the value that Snowflake provides to its users.

Moreover, Snowflake has consistently innovated within its core area. The introduction of features like Snowpark, which allows data engineers and scientists to build data pipelines and machine learning models directly within Snowflake, has expanded the platform’s utility and appeal. This innovation has helped Snowflake stay ahead of the curve in an increasingly competitive market.

One of the most significant trends in technology today is the rise of artificial intelligence (AI). While some critics argue that Snowflake has been slow to capitalize on the AI wave, the company’s approach has been more strategic than it may appear at first glance.

Snowflake’s strength lies in its ability to handle structured data at scale. As AI becomes more integrated into business processes, the need for high-quality, structured data will only grow. Snowflake’s platform is uniquely positioned to serve as the foundation for AI-driven initiatives, providing the reliable, scalable data infrastructure that businesses need to power their AI models.

Furthermore, Snowflake has been making strides in expanding its AI capabilities. The company’s acquisition of Applica, a leader in AI-driven document understanding, is a clear indication of its commitment to integrating AI into its platform. This move positions Snowflake to provide AI solutions that complement its existing offerings, making it an even more valuable partner for businesses looking to harness the power of AI.

In addition, Snowflake’s focus on data sharing and collaboration through its Data Marketplace is another strategic advantage. By enabling organizations to share and monetize their data securely, Snowflake is tapping into the growing demand for data-driven insights, which are increasingly powered by AI. This ecosystem approach not only enhances the value of Snowflake’s platform but also creates new revenue streams for its customers.

Critics often point to Snowflake’s stock performance as a sign of weakness, but this perspective misses the bigger picture. Snowflake is a company with a solid financial foundation, and its recent earnings reports highlight its resilience in a challenging market.

For example, in its most recent quarter, Snowflake reported total revenue of $828.7 million, up nearly 29% year-on-year. This growth is impressive, particularly given the current economic climate. Moreover, Snowflake’s remaining performance obligations (RPO), which represent contracted revenue that will be recognized in the future, grew by 48% to $5.2 billion. This metric is a strong indicator of the company’s future revenue potential and reflects the confidence that customers have in Snowflake’s long-term value.

Snowflake’s balance sheet is also robust, with $3.2 billion in cash, cash equivalents, and short-term investments. This financial strength gives the company the flexibility to invest in growth opportunities, whether through strategic acquisitions or continued innovation within its platform. It also provides a cushion against market volatility, ensuring that Snowflake can weather economic downturns while continuing to deliver value to its customers.

One of the challenges that Snowflake faces is the short-term focus of Wall Street. Investors often react to quarterly earnings and guidance without fully appreciating the long-term potential of a company like Snowflake. The recent dip in Snowflake’s stock price, following what was actually a strong earnings report, is a prime example of this disconnect.

Despite reporting revenue and earnings that exceeded Wall Street’s expectations, Snowflake’s conservative guidance for fiscal 2025 led to a nearly 15% drop in its stock price. This reaction overlooks the fact that Snowflake’s management is taking a prudent approach in a volatile market. By setting realistic expectations, Snowflake is positioning itself for sustainable growth rather than chasing short-term gains.

It’s also worth noting that many analysts remain bullish on Snowflake’s long-term prospects. While some have lowered their price targets in response to market conditions, the consensus is that Snowflake still has significant upside potential. The company’s average target price suggests a potential upside of over 60%, and some analysts believe the stock could more than double over the next 12 months.

Looking ahead, Snowflake’s path to success lies in continuing to execute on its strategic vision while remaining adaptable to changing market conditions. The company’s focus on its core data platform, combined with its efforts to expand into AI and data collaboration, positions it well for the future.

One of the areas where Snowflake could see significant growth is in the expansion of its ecosystem. By building partnerships with other technology providers and enabling more seamless integrations with third-party tools, Snowflake can enhance the value of its platform and attract new customers. The company’s recent partnerships with companies like Nvidia, to integrate AI capabilities into Snowflake’s platform, are a step in this direction.

Another opportunity lies in international expansion. While Snowflake has a strong presence in the U.S., there is significant potential for growth in other markets, particularly in Europe and Asia. As businesses in these regions continue to embrace cloud computing and data-driven decision-making, Snowflake’s platform could become an essential part of their technology stack.

Finally, Snowflake’s commitment to innovation will be key to its long-term success. By staying at the forefront of technological developments and continuously improving its platform, Snowflake can maintain its competitive edge and continue to deliver value to its customers.

Sridhar Ramaswamy, the new global CEO of Snowflake

While Snowflake has faced its share of challenges, the company remains a strong player in the cloud data space with significant growth potential. Its focus on delivering value to customers, coupled with its strategic investments in AI and data collaboration, positions it well for the future.

Warren Buffett’s investment in Snowflake was not a mistake, but rather a recognition of the company’s long-term potential. While the stock’s recent performance may have disappointed some investors, those with a long-term view will likely see Snowflake as a winner in the making.

In a market that often values short-term gains over long-term strategy, Snowflake’s approach may seem unconventional. But it’s this very focus on sustainable growth and innovation that will allow Snowflake to thrive in the years to come. As the company continues to build on its strengths and navigate the challenges ahead, Snowflake has the potential to not only meet but exceed the high expectations that have been set for it.

📣 Want to advertise in AIM Research? Book here >

Cypher 2024

21-22 Nov 2024, Santa Clara Convention Center, CA

A Vendor Briefing is a research tool for our industry analysts, and an opportunity for a vendor to present its products, services and business strategies to analysts who cover the vendor specifically or a related technology or market.

AIM Research encourages technology vendors and agencies to brief our team for PeMa Quadrants, when introducing a new product, changing a business model, or forming a partnership, merger, or acquisition.