ServiceNow Builds Out CRM Platform in Direct Competition With Salesforce

- By Anshika Mathews

- Published on

If you ask many customers today, are they happy with their CRM? Ninety percent will say no and that’s a fact.

ServiceNow has expanded its portfolio in the customer relationship management (CRM) software market, introducing a set of AI-powered capabilities and product integrations designed to handle customer service, order fulfillment, and workflow automation on a unified architecture.

The expansion, formally announced at its Knowledge 2025 conference, builds on ServiceNow’s existing presence in customer service management and coincides with several strategic partnerships and acquisitions. Earlier this year, the company acquired AI automation platform Moveworks for $2.85 billion, its largest deal to date. It has also rolled out integrations with NICE, Zoom, and Logiciq, aimed at connecting front-, middle-, and back-office operations within a single system.

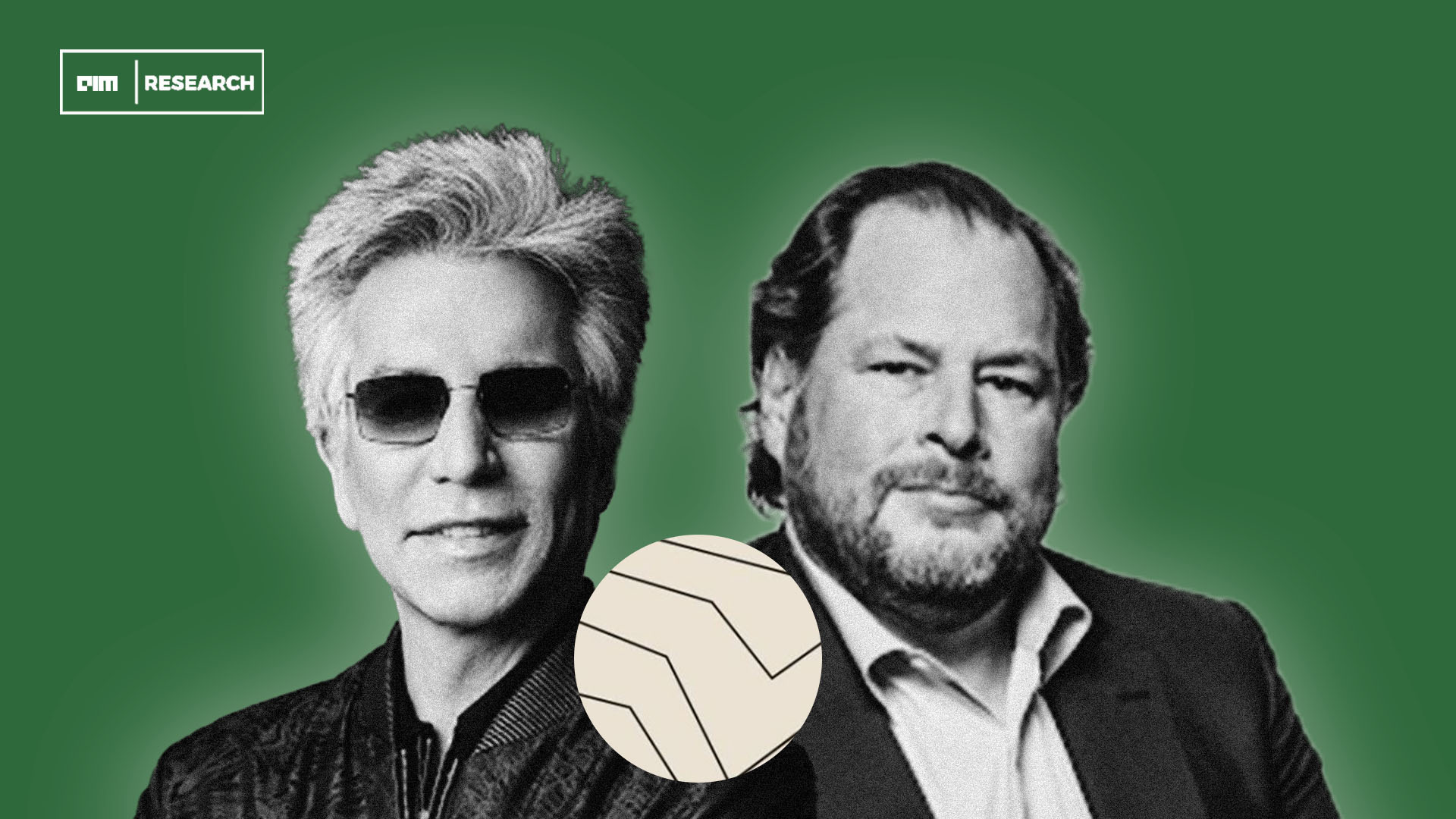

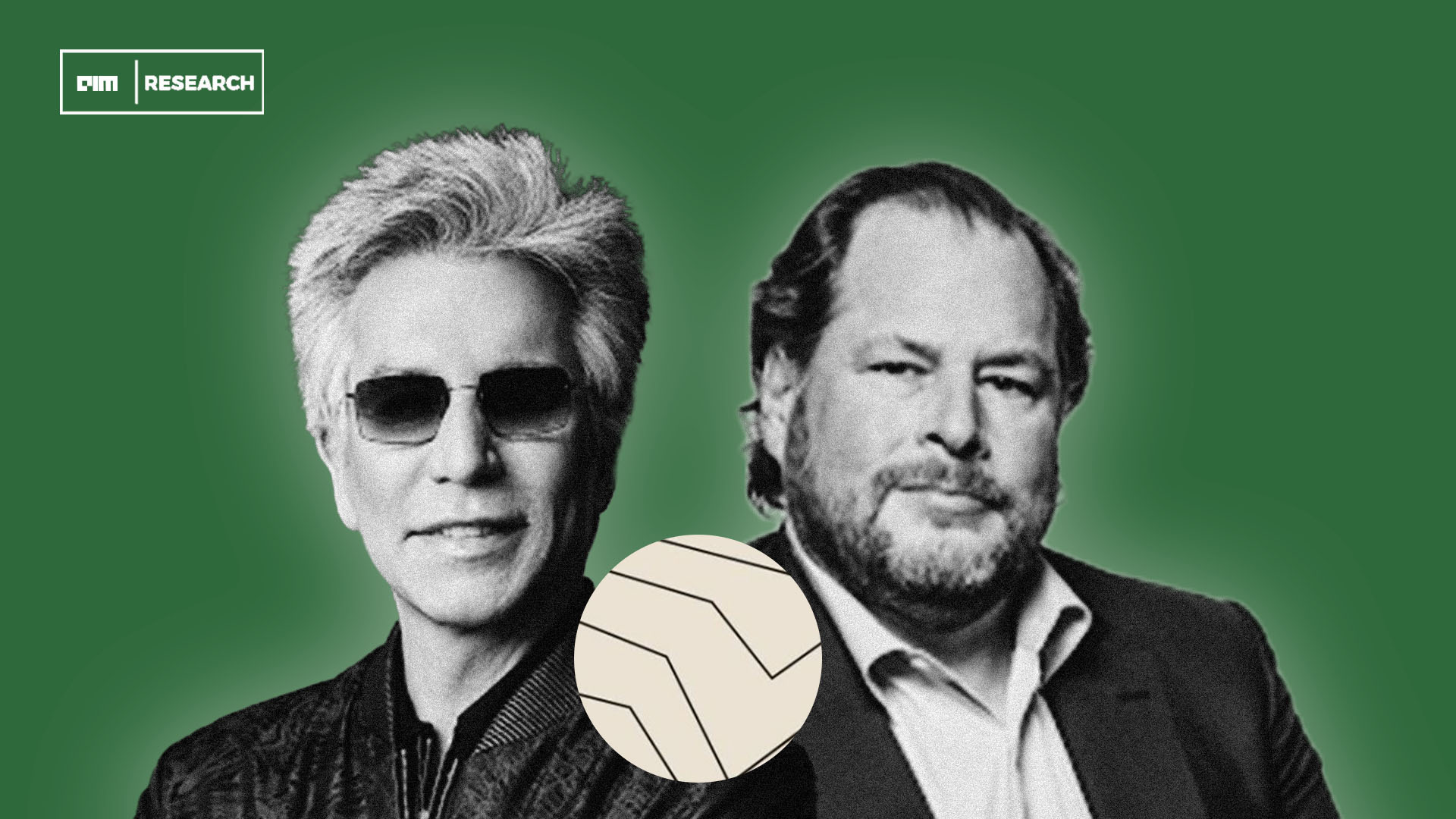

The moves place the enterprise software firm into more direct competition with Salesforce, the CRM category leader. In late 2024, Salesforce CEO Marc Benioff, appearing on CNBC’s Mad Money, compared ServiceNow to a “Wienerschnitzel” to Salesforce’s “McDonald’s.”

Bill McDermott said the company’s focus is not on replicating traditional CRM functions but rather rethinking how enterprises manage customer relationships end-to-end—from intake to resolution. “It’s a big market, but in that market, the customers have suffered a lot over the last decade,” he said. “Right now, the cost of losing a customer is higher than ever. And the loss rate of businesses is higher than ever—30% greater than it’s been. So the customers are saying, ‘Whatever you’re feeding me, it’s not working.’”

ServiceNow’s CRM capabilities now span customer service, order management, and field service workflows. The offering draws on the company’s core strength in workflow automation and process orchestration, extending those principles to customer-facing operations.

According to Terence Chesire, vice president of CRM and industry workflows at ServiceNow, legacy CRM platforms have historically emphasized sales enablement and omnichannel communications without adequately solving downstream problems. “For over a decade, legacy CRM vendors promised a world where a 360 view and omnichannel was the Holy Grail… but it didn’t [deliver],” Chesire said during a Knowledge 2025 briefing. “In customer service, you need more than just great omnichannel intake of a request. You also need to orchestrate and automate the hard part, which is the resolution and fulfillment.”

Amit Zavery, president, chief product officer, and COO at ServiceNow, said that ServiceNow’s entry into CRM isn’t new, but rather a natural evolution. “We’ve been solving customer issues, resolving their concerns, fixing things anyway for a lot of employees for many, many years,” he said. “We can easily extend that capability now to customer service.”

The company has also expanded into CPQ (configure, price, quote) and order management. “It’s not about just finding information, but completing a process,” Zavery said. “In order management, you finish a task and get an order shipped or fulfilled.”

Zavery said existing CRM systems are too fragmented. “There’s a lot of pain in today’s CRM stacks—multiple systems, siloed architectures, lack of flexibility,” he said. “What we’re trying to do is unify those workflows using AI agents and dynamic orchestration.”

Salesforce, which dominates the CRM market, has also sharpened its focus on generative AI and autonomous agents. CEO Marc Benioff has described Salesforce’s Agent Force strategy as “practical, specific, and tactical,” designed to give customers an executable AI playbook after many early experiments with generative AI failed to yield results. “Agent Force is designed to give everybody a win,” Benioff said in recent comments on the company’s AI direction.

Benioff has pushed the concept of “agent-first” organizations—businesses that use AI agents to interact directly with customers and operate more autonomously—while acknowledging the limitations of current systems. He emphasized that these agents depend on a consistent and federated data layer, built not only on Salesforce’s own 230 petabytes of customer data but also through integrations with platforms like Snowflake, Databricks, Shopify, BigQuery, and Amazon S3.

“The future is about bringing data together for customers,” Benioff said, citing next-generation applications like a revamped Tableau and the ability to deploy AI agents at scale.

To bolster this unification, ServiceNow has entered into several enterprise partnerships. Through a collaboration with NICE, ServiceNow is integrating its AI and automation platform with NICE’s customer engagement infrastructure. The goal is to bridge customer-facing interactions with fulfillment processes using shared data and automation logic.

“Many businesses face the challenge of fragmented systems and siloed workflows,” said Barry Cooper, president of NICE’s CX division. “By bringing together NICE’s AI-driven customer service automation and ServiceNow’s robust AI platform, we’re enabling businesses to streamline their operations and deliver fully automated customer service fulfillment.”

Michael Ramsey, general vice president for CRM and industry workflows at ServiceNow, said the joint offering supports “end-to-end workflows from front- to back-office tools and platforms.”

Another integration with Zoom aims to centralize communications inside the ServiceNow interface. Agents can manage voice, video, and chat in one workspace, while AI capabilities from both platforms provide real-time sentiment analysis, call summaries, and workflow automation. The combined product, called “Unified Engagement,” will be available in the ServiceNow Store later this year.

McDermott said these partnerships are part of a broader effort to simplify tech stacks and reduce the need for disconnected legacy tools. “You can put that platform in, exit out lots of OPEX on lots of legacy that you don’t need to be paying for,” he said, “so you can invest in a platform that’s going to cut your costs and help you grow again.”

ServiceNow executives consistently draw a distinction between their offering and those of traditional CRM platforms, which are often described as “systems of record.” “The future of CRM is a combination of AI plus data plus workflows,” said Andrew Miljanovski, vice president advisor at Gartner. “Traditionally, the CRM was a system of record, but ServiceNow prides itself as a system of action.”

McDermott echoed that view. “We’re trying to integrate with all of the large language models out there and have a workflow data fabric that connects with data sources from those old systems of record or, frankly, any data lake—all into one central nervous system, which is the ServiceNow platform.”

Stephen Elliot, group VP at IDC, said the platform approach may appeal to CIOs looking to consolidate tools. “It’s really about the data, and ServiceNow has access to all this data through a unified data model,” he said.

Despite overlapping with Salesforce in customer service, ServiceNow executives said they do not view themselves as a full-suite CRM provider. “We are not doing a Salesforce automation product. We’re not doing marketing automation,” said Zavery. “We are solving for complex workflows like customer service, order management, and CPQ.”

Internally, the company does not appear preoccupied with what the market calls its offerings. “Many customers have deployed our CSM product, which is CRM,” Zavery said. “Somehow people say, ‘Oh my god, you’re calling it CRM,’ but that’s what it is. I don’t know what else you call it.”

ServiceNow’s focus, Zavery said, is not on replacing vendors but integrating with them when needed. “We’re not the decision-maker—customers are,” he said. “We interoperate with 100-plus different systems. Customers do not have to replace existing investment to get value.”

Still, ServiceNow is actively displacing incumbent vendors in some areas. “If you ask many customers today, are they happy with their CRM? Ninety percent will say no—and that’s a fact,” Zavery said.

The company expects to continue growing in areas where customers demand better workflow integration and lower complexity. “Most of those vendors like SAP or Salesforce are siloed by one area,” Zavery added. “They’re all providing pieces, which is great. But when you connect those things together—who will do that job for you? None of them are doing that. We are doing that for them.”

📣 Want to advertise in AIM Research? Book here >

Cypher 2024

21-22 Nov 2024, Santa Clara Convention Center, CA

A Vendor Briefing is a research tool for our industry analysts, and an opportunity for a vendor to present its products, services and business strategies to analysts who cover the vendor specifically or a related technology or market.

AIM Research encourages technology vendors and agencies to brief our team for PeMa Quadrants, when introducing a new product, changing a business model, or forming a partnership, merger, or acquisition.